Credit card debt

Understand what credit card debt is, how it works and the impact on your credit score. Plus, the routes you can take if you’re facing financial difficulties.

What is credit card debt?

Credit card debt is the amount of money you owe to a credit card company when you use your card to make purchases, withdraw cash, or pay bills.

When you use a credit card, you’re borrowing money from the card issuer with the promise to pay it back by an agreed date. When you don’t pay the full balance, the remaining amount becomes debt.

This debt will start to build up interest, which is often high compared to other loans. So, the longer you take to pay it off, the more you owe.

How do credit card repayments work?

Credit card repayments can differ from person to person – depending on how you use your card. But staying in control of your repayments is important to avoid interest charges and keep your account in good standing. It’s recommended that you…

- Check your credit card statements on a regular basis. This way, you’ll spot any interest charges that might show up on your next bill. It’s also good as a reminder of what your minimum payment is, or if anything looks out of place.

- Make at least your minimum payment on time each month. A missed payment can impact your credit score, making it difficult to get credit in the future.

- Pay more than the minimum amount each month if you can. This helps you lower borrowing costs and help reduce the amount of interest owed.

- Pay off your balance in full each month if you can afford to – to avoid interest building up. Paying in full can help you keep your debt under control and maintain a good credit score.

You can make as many payments each month as you want, which helps lower your balance and borrowing costs. You can also set up a Direct Debit, which will take payments automatically and help you avoid late fees.

Money worries? Struggling to pay credit card bills

If you’re struggling with credit card debt or can’t pay your lender, don’t suffer alone. We’re here to give you the help and support you need, whatever the situation.

If you’re a Vanquis customer and worried about your finances, please reach out to us as soon as you can. Call our team on 0330 099 3000* (if you’re a credit card customer). We’re here to listen and help you move forward.

If you’re not a Vanquis customer, start by contacting your bank, building society, or other financial provider for support.

Featured article

What is adverse credit?

Credit Card Advantages

How to choose the best credit card

How many credit cards

What Is a CCJ?

Get peace of mind with our benefits calculator

Make sure you’re not missing out on financial support.

Tips to pay off credit card debt

The ‘debt snowball’ method

This method focuses on paying off your smallest debts first. Start by paying the minimum monthly payment on all your debts. Then, put any extra money towards the smallest balance.

Once you pay off a debt, you put the money used for that payment towards the next smallest debt. Paying off smaller debts can keep you motivated to tackle your larger debts.

The ‘debt avalanche’ method

This method focuses on paying off debts with the highest interest rates first, regardless of which one has the lowest balance. It works by you making the minimum payments on all your accounts, then paying extra on the account with the highest interest rate.

Keep doing this until you’ve cleared all your debts. This method can help you save on interest payments in the long run.

Consolidate debts with a balance transfer

Balance transfer cards bring everything together – transferring other balances on to the same card. They simplify monthly payments, lower interest charges, and make debts easier to manage.

If you have debts on several credit cards with high interest rates, consider moving them to a balance transfer card with low or 0% interest. This can help you pay off your debts faster and reduce mounting interest.

But, like any card, there are risks. Low interest rates on their balance transfer could tempt some people to overspend. And after the low-interest introductory period ends, rates on unpaid balances can increase – sometimes to levels higher than you were paying before.

Consolidate debts with a personal loan

A personal loan can help you combine your credit card debt into one monthly payment. It’s a way to spread repayment costs over a set period, from a few months to years. This can help make monthly payments easier to manage.

As with any loan, you’ll need to pay interest on it, this means you’ll pay more back than you originally borrowed. Missed or late payments can negatively impact your credit score and result in the lender taking action against you to collect the unpaid debt, fees and interest.

Set up an Individual Voluntary Arrangement (IVA)

While we recommend exploring other routes first, an IVA could be an option for you. This is a legally binding agreement with your creditors to pay all or part of your debt within a set period. After this, any remaining debt is written off.

This option helps you manage debt, protect your assets, and avoid bankruptcy. But it can impact your credit score and may come with extra costs and fees. So, do your research and weigh up your options before making a decision.

Cut back on discretionary spending

When it comes to cutting back on spending, it can be hard to know where to start. It’s not about changing your whole lifestyle, but making small, temporary changes to improve your finances. Some things you could try today to cut back on spending include:

- ‘Pausing before you purchase’ – the 24-hour rule. After you’ve taken care of your essentials, when you want to buy something, try pausing for 24 hours. See how you feel after this time, and whether you still need (or want) it.

- Set a proper monthly budget and stick to it.

- Regularly review your subscriptions. It’s easy to forget services you signed up for ages ago. So, look through your subscriptions and decide if you’re getting value. If not, say goodbye.

- Plan your meals. Food is a big spending category for a lot of people, so planning ahead can not only save you time but money too. It also leads to less waste as everything has been planned out.

Set up a Direct Debit

A Direct Debit is an easy way to make your credit card payment each month. Payments are automatically taken from your bank or building society account, and you can choose what you would like to pay on your due date each month. This can be:

- Your full statement balance

- A percentage of the statement balance

- The minimum payment

- A fixed amount

If you’re a Vanquis customer, you can set up a Direct Debit in the Vanquis app.

We want to support you

“Feeling overwhelmed by credit card debt? You’re not alone, and it’s completely normal to feel this way. The good news is that change is possible – one step at a time.

“Start by choosing a single strategy from this article and putting it into practice today. Every small action adds up, helping you move closer to a debt-free future you can be proud of.”

Matt Oliver, Lead Credit Risk Analyst at Vanquis.

Frequently Asked Questions

How long does it take to pay off credit card debt?

The time to pay off credit card debt varies for each person. It depends on factors like how much you owe, your monthly payments, and your interest rate.

For example, if you only pay the minimum amount each month, it could take years to clear your balance. This is due to the small amount but also the interest mounting up. You can reduce the payoff time by increasing your monthly payments or using one of the repayment methods mentioned above.

Should I close my credit card account once I’ve paid off a debt?

Closing old credit accounts can shorten your credit history. Old accounts can show more reliability than newer accounts and prove to lenders that you have experience in managing accounts over extended periods of time.

How do I pay off persistent debt?

If your account is in ‘persistent debt’, you’ve paid more in interest, fees, and charges than you have towards what you’ve borrowed, for 18 months or more.

This can happen if you’ve only been making minimum or low monthly payments for a long time. It could take several years to repay what you’ve borrowed – and cost you more in interest and charges.

At Vanquis, if your account is in persistent debt, we’ll contact you to let you know and provide steps to help you out of it.

How can I avoid paying interest?

To avoid paying interest on credit card debt, try to pay off your balance in full before the due date each month.

Doing this takes advantage of the grace period where you won’t be charged interest – the time between the end of your monthly billing cycle (sometimes called your statement closing date) and the due date that appears on your credit card statement.

If you can’t pay the balance in full, cover at least the minimum amount to prevent late fees and a negative impact on your credit score. You can also set reminders for payment due dates or arrange a Direct Debit to make sure payments are made on time.

Other ways to keep interest low include:

- Look out for 0% balance transfer offers

- Switch to a low-interest credit card

- Avoid cash withdrawals (there’s no interest-free period with these)

What is a credit limit?

A credit limit is the maximum amount you can borrow on a credit card – set by your card issuer. It depends on factors like your credit score, payment history, and income. Knowing your credit card limit helps you control your spending and avoid extra fees or penalties for going over.

Keeping your credit utilisation below 30% of your credit limit can positively impact your credit score.

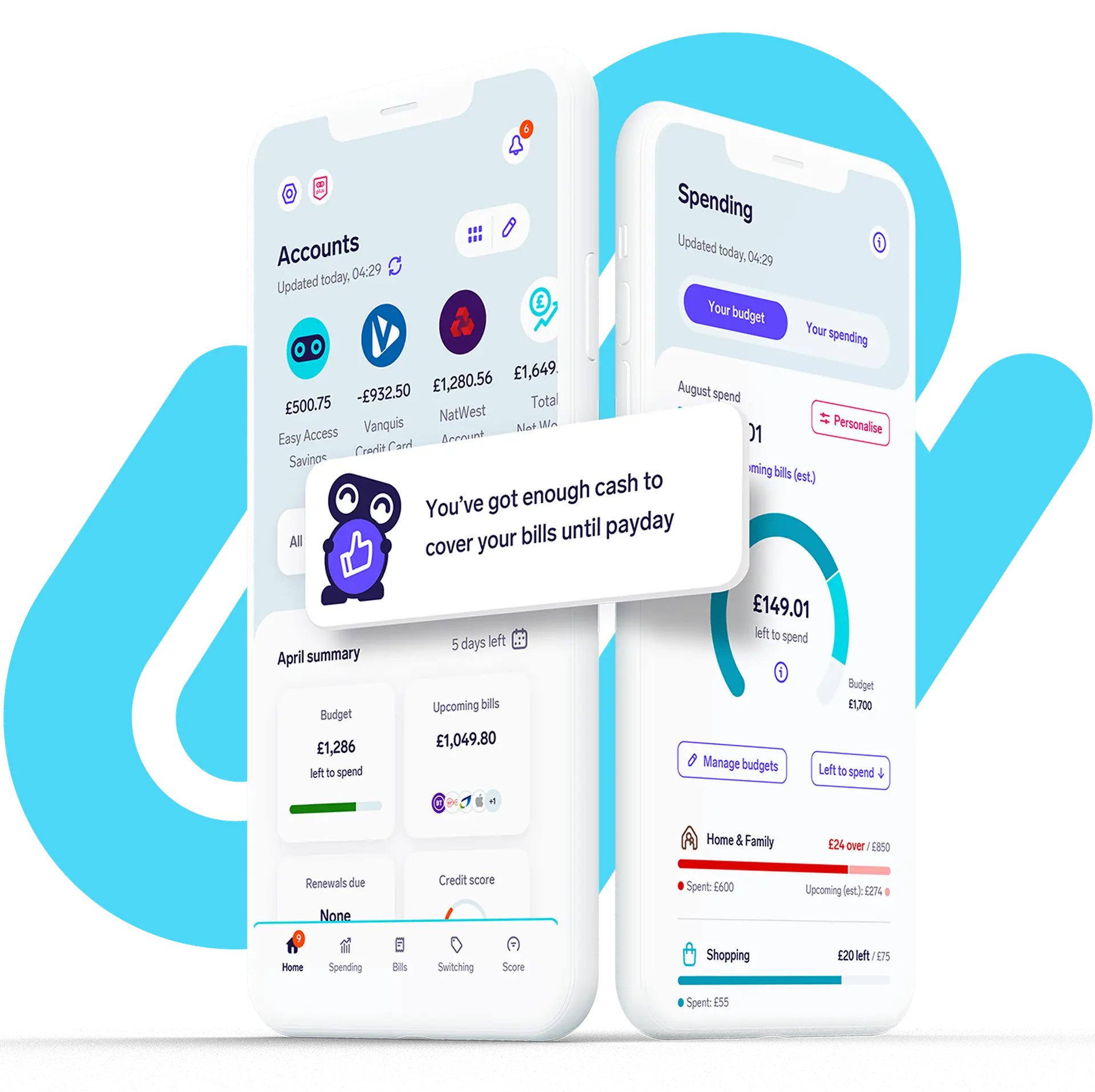

Want extra help cutting your costs? Here’s what you can do with Snoop.

- See everything in one app

- Track your spending and set budgets

- Build your credit score

- Cut your bills

Help and support

If you think you may have a problem making your payments, please give us a call on 0330 099 3002*. Our team is here to listen, not judge, and we’ll be sensitive to your individual situation.

We also work with several external organisations that offer free impartial advice and support.

They can recommend the most appropriate debt solution for your situation to help you get back on track with your finances. This could be through a Debt Management Plan, a Debt Respite Scheme, or an alternative route. These organisations include:

You can find more info and support at on our support beyond us page.

- Debt Respite Scheme (also known as Breathing Space): This government scheme provides up to 60 days of protection from most interest, charges, and enforcement actions.

- Debt Management Plan: This is an agreement between you and your creditors to help you pay off your debts in a more manageable way.

*Call charge information

Network charges may apply. Calls to 01 and 03 numbers from UK landlines and mobiles are normally included in free plan minutes if available; otherwise calls to 03 numbers cost the same as calls to 01/02 prefix numbers. Calls to 0800 or 0808 numbers are free from mobiles and landlines..

More from Matt

View all articles

How to switch credit cards

How do you switch to a new credit card? Is switching credit cards the right option for me? What are the pros and cons of switching? Learn more in our article....

What is adverse credit?

What is a personal adverse credit history? How does this impact your ability to get a credit card, loan or mortgage? What causes adverse credit? We answer these questions and more....

What Are the Different Types of Credit Card?

What are the different credit card types? Learn more in our detailed guide about balance transfer cards, money transfer cards, credit builder cards and more....

What are Credit Card Interest Rates?

When thinking about a credit card, it's important to be aware of the different fees and charges that could affect you. Let us help you navigate the world of credit card charges so you can make an informed decision....

Credit Card Minimum Payments

When thinking about a credit card, it's important to be aware of the different fees and charges that could affect you. Let us help you navigate the world of credit card charges so you can make an informed decision....