Money worries?

Money worries can affect anyone at any time. That’s why we’re here to help you get back on track. In our guide, you can see the support we offer and learn more about the other places you can get help.

We can help you

It’s important you know that we’re here to give you the help and support you need, whatever the situation.

You could be dealing with specific personal issues which affect your ability to manage your account. Or you might be struggling with mental or physical health problems, unemployment or being a carer for a relative or dependent.

We know it can be tough to deal with and you could be feeling overwhelmed and anxious. But we have solutions.

It’s important not to wait to get help – the earlier we know what you’re facing, the sooner we can offer you the support you need. No judgement – only help, support and understanding.

Take positive steps

Take a look at the steps below to see how you can start to improve your situation.

Get in touch

If you're a Vanquis customer and worried about your finances, please reach out to us as soon as you can. Call our friendly team on 0330 099 3002* (if you're a credit card customer) or 0191 505 0033* (if you're a savings customer) - we're here to listen and help you find a way forward.

If you're not a Vanquis customer, please start by contacting your bank, building society or other financial provider for support.

You can find our opening hours and contact information on our contact us page.

Look at your current financial position

There are a number of things you can do to make small improvements to your situation. If you haven’t already, a good first step is to create a budget. This can include a list of all your outgoings, helping you spot any potential savings to be made.

The government-backed Money Helper website is a great place to find step-by-step instructions on what you need to do. It’ll help you make sure you include all the bills and other info needed to set up a budget.

It’s important to know how much debt you have, so why not start by looking at your credit score with one of the main credit reference agencies: Experian, Equifax and TransUnion? Checking your credit report will show which organisations you owe money to and help you spot any incorrect info on your record.

Finally, UK debt charity StepChange has a great article about how to start looking at your current debts.

Check out the other support available

If trying to improve your financial situation feels overwhelming, reaching out to external organisations could be a good move. Visit our more help and support page to see who offers free assistance.

Debt Respite Schemes (‘Breathing Space’)

Are you working with a debt advice provider who’s authorised by the Financial Conduct Authority (FCA)? If so, you could benefit from the Debt Respite Scheme, more commonly known as ‘Breathing Space’. This scheme allows for a period of protection for those with problem debts and can last up to 60 days – or more in certain cases.

During 'Breathing Space', we’ll work with your debt advice provider and no interest will be applied to your account or enforcement action taken for the period it's active.

Just so you know, this scheme can only be started by a FCA authorised debt advice provider or local authority (where they provide debt advice to residents). Please ask your advice service about ‘Breathing Space’. And if you need more info, this StepChange article should be useful.

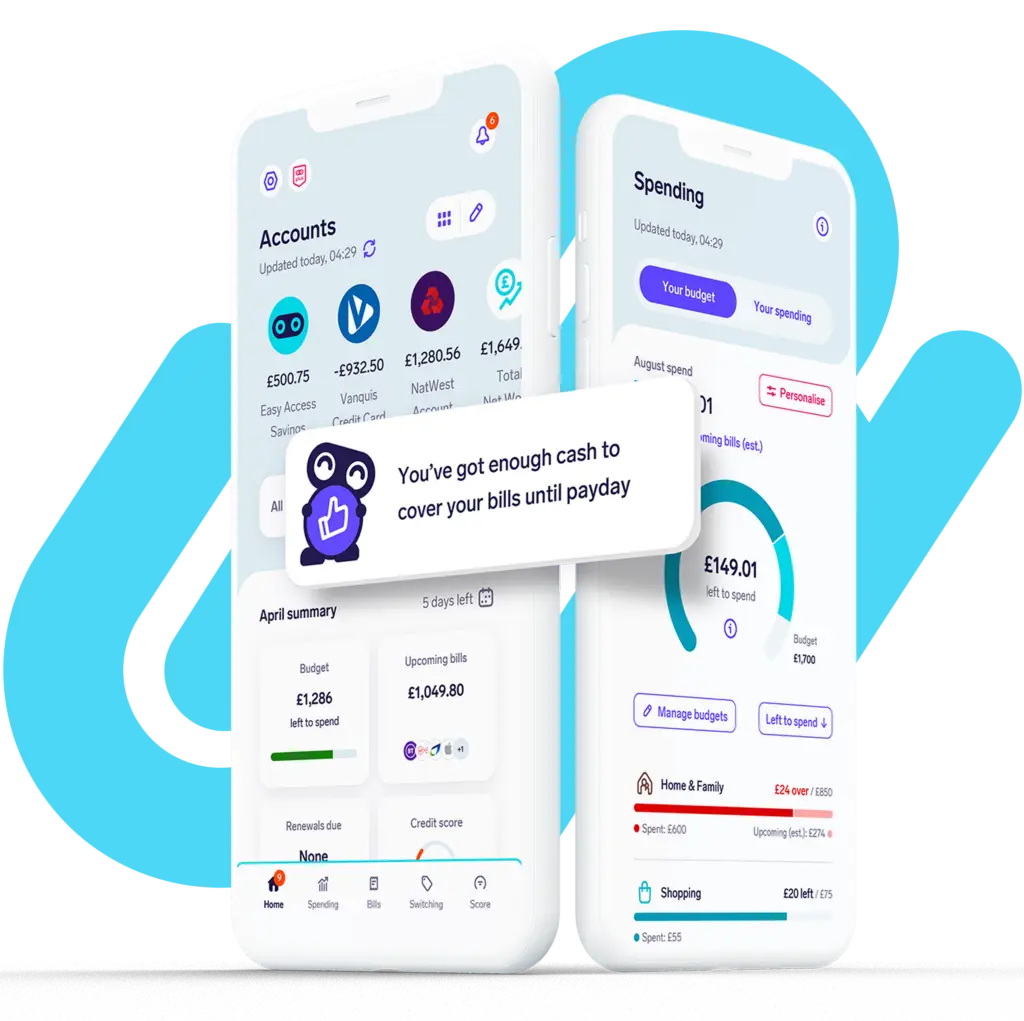

Let Snoop help you budget and save money

- See everything in one app

- Track your spending and set budgets

- Build your credit score

- Cut your bills

*Call charge information

Network charges may apply. Calls to 01 and 03 numbers from UK landlines and mobiles are normally included in free plan minutes if available; otherwise calls to 03 numbers cost the same as calls to 01/02 prefix numbers. Calls to 0800 or 0808 numbers are free from mobiles and landlines.