Adverse credit history explained

If you’ve experienced difficulties with your credit, you may be wondering how this can impact you. We cover what causes adverse credit, how long negative markers stay on your credit file, and steps to improve it.

Adverse credit history explained

If you’ve experienced difficulties with your credit, you may be wondering how this can impact you. We cover what causes adverse credit, how long negative markers stay on your credit file, and steps to improve it.

What is an adverse credit history?

What causes adverse credit history?

Where do credit reference agencies (CRAs) collect their info?

How does adverse credit affect your finances?

How does adverse credit affect my ability to get loans?

How does adverse credit affect my ability to get a mortgage?

How to fix an adverse credit history?

We want to support you

What is an adverse credit history?

Adverse credit history – sometimes known as bad credit – is a result of negative markers on your credit file. It can include repayment history on credit cards and loans, and other forms of credit.

When you fail to meet your financial requirements – for example, if you miss payments – it leaves a mark on your credit report. This can make it difficult to get approved for credit cards, loans, or mortgages in the future.

What causes adverse credit history?

Many factors on your credit file can lead to an adverse credit history. Here are some of them:

Late or missed payments

What is the impact? This is when you miss a payment for 30 days or more. It signals to lenders that you may struggle to make future payments.

How long does it stay on your credit file? Up to six years.

Charge-off

What is the impact? When a lender thinks you’re unlikely to pay your debt (for example, you miss scheduled payments for many months) they may write it off as a charge-off. This shows serious default behaviour and is damaging to your credit score.

How long does it stay on your credit file? Up to seven years.

Bankruptcy

What is the impact? This is a legal process taken when you’re no longer able to repay your debts. It’s considered one of the most serious forms of adverse credit.

Bankruptcy usually lasts for 12 months and you may have trouble borrowing any money during this period. After this, your bankruptcy is usually ‘discharged’ but will stay on your credit file for longer.

How long does it stay on your credit file? Up to six years.

Foreclosure (house repossession)

What is the impact? If you can’t make payments on your mortgage, the lender may take possession of your home. This can have a big impact on your credit score and make it hard to get loans in the future.

How long does it stay on your credit file? Up to seven years.

Default

What is the impact? If you miss payments for several months, the lender will close your account. This results in a default and can have a severe impact on your credit score, making it difficult to get credit in the future.

How long does it stay on your credit file? Up to six years.

CCJ

What is the impact? A County Court Judgment (CCJ) is a court order. It can be issued if you owe money and miss your repayment deadlines. This could have a serious impact on your credit score and your chances of getting credit.

How long does it stay on your credit file? Up to six years.

IVA

What is the impact? An Individual Voluntary Agreement (IVA) is a legally binding agreement with your creditors to pay your debts at a lower rate or settle your debts over time.

IVA has potential advantages like helping with debt management and helping you avoid bankruptcy.

But it also has potential disadvantages – it can impact your credit rating, lead to extra costs and fees, and cause temporary restrictions on your financial activities, like accessing credit.

How long does it stay on your credit file? Up to six years.

Featured article

How to pay off credit card debt

Credit Card Advantages

How to choose the best credit card

How many credit cards

What Is a CCJ?

Get peace of mind with our benefits calculator

Make sure you’re not missing out on financial support.

Where do credit reference agencies (CRAs) collect their info?

Money worries: If you’re experiencing financial difficulties or you’re worried you can no longer make your payments, please reach out. We’re here to help you through the good times and the tough times.

How does adverse credit affect your finances?

An adverse credit history can make it harder to get credit in the future. It can lead to higher interest rates on credit cards and loans, as lenders see you as a high-risk borrower. This can lead to higher costs over time, fewer borrowing options, and lower loan amounts.

Improving your credit score can increase your chances of getting approved and help you get credit with higher limits and lower interest rates.

How does adverse credit affect my ability to get loans?

Adverse credit may limit your options when it comes to applying for a loan. You can get a loan with bad credit but expect much higher interest rates than those from regular lenders.

This means you might end up repaying a lot more than you borrowed, and your monthly payments could be higher than normal. Having adverse credit may also impact your ability to get vehicle finance and other types of credit.

How does adverse credit affect my ability to get a mortgage?

Getting a mortgage with adverse credit can be difficult, but not impossible. Lenders are more cautious about giving loans to those with bad credit, especially mortgages. This is because the financial risks can be much higher. You might face higher interest rates.

How to fix an adverse credit history?

If you’re struggling with adverse credit, improving your credit history is possible. Here are some practical steps to get you started:

Pay bills on time

Paying on time shows lenders you’re a reliable borrower. It also shows you can handle credit responsibly. This makes you more appealing to lenders. They’ll trust you to make payments regularly, which can boost your credit score. Late or missed payments will be reported to credit reference agencies by your lender. This often leads to a lower credit score.

Settle debts

If you have outstanding debts, work towards paying them off. Settling overdue accounts can improve your credit score.

Register on the electoral roll

Making sure you’re on the electoral roll can make a big difference to your credit rating.

When you register for the electoral roll, you need to share some details about yourself. This info helps lenders check your identity and proves your address.

It can also help you save time on credit applications and avoid the risk of identity theft.

Keep credit utilisation low

Your credit utilisation is the percentage of your total available credit you’re using. So, if you have a £4,000 credit card limit and you’re using £2,000, your credit utilisation is 50%.

High credit utilisation can be a sign that you depend on borrowing and aren’t using credit responsibly. A lower percentage may show you can manage credit well.

If you can, try not to use a large amount of the credit available to you – to keep your credit utilisation figure down. The general view is it’s a good idea to keep your credit utilisation below 30%.

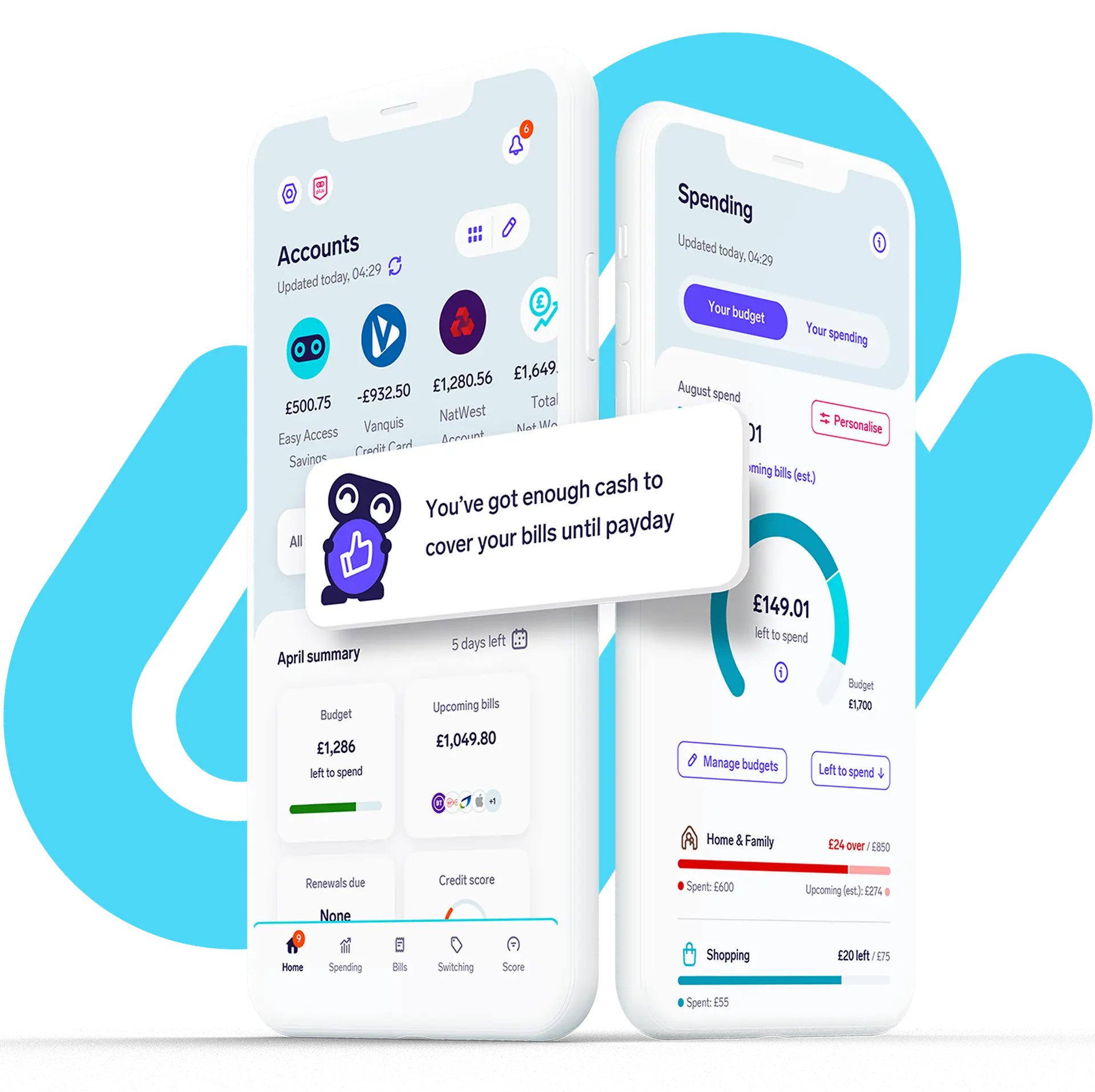

Our money-saving app Snoop can help you track your spending and set up personalised budgets to keep it under control.

Don’t close old accounts

Closing old credit accounts can shorten your credit history. This may lower your average account age and reduce your credit score.

Pay more than the minimum

When you can, it’s good to pay more than the minimum amount. This shows lenders you’re serious about reducing your debt. It also helps improve your creditworthiness.

Check for errors on your credit report

Errors in your report could be damaging your credit score.

You can check your credit report for free with services like Experian, ClearScore, and Credit Karma. These sites also offer personal tips to help you improve your credit score.

Credit cards for bad credit

If you’re looking to improve your credit score, our Credit Builder Credit Card for bad credit could help. Check if you’re eligible today with no impact on your credit score.

Representative 37.9% APR (variable)

We want to support you

“Life doesn’t always go as planned. If your credit has taken a hit, we’re here to help. With the right support and steps, you can rebuild your credit score and boost your confidence in your financial future. Over the years, we’ve helped thousands of customers to do just that and we’re keen to help even more.”

Matt Oliver, Lead Credit Risk Analyst at Vanquis.

Want extra help cutting your costs? Here’s what you can do with Snoop.

- See everything in one app

- Track your spending and set budgets

- Build your credit score

- Cut your bills

More from Matt

View all articles

How to switch credit cards

How do you switch to a new credit card? Is switching credit cards the right option for me? What are the pros and cons of switching? Learn more in our article....

How to pay off credit card debt

Want to reduce credit card debt? Learn how to reduce credit card debt with smart budgeting, payment strategies, and tips to take control of your finances....

What Are the Different Types of Credit Card?

What are the different credit card types? Learn more in our detailed guide about balance transfer cards, money transfer cards, credit builder cards and more....

What are Credit Card Interest Rates?

When thinking about a credit card, it's important to be aware of the different fees and charges that could affect you. Let us help you navigate the world of credit card charges so you can make an informed decision....

Credit Card Minimum Payments

When thinking about a credit card, it's important to be aware of the different fees and charges that could affect you. Let us help you navigate the world of credit card charges so you can make an informed decision....